For Dutch students and students from the EU/EEA only

You can apply for student finance yourself online via www.duo.nl. If you are enrolled in a bachelor, associate degree of master programme, you will be eligible for student finance if you have not turned 18 yet. You will also receive a public transportation card.

Student finance

Go to tio.nl/student-finance for up-to-date information on bachelor student finance amounts.

Go to www.duo.nl for more information about student finance. If you have any specific questions about student finance, you can schedule an appointment at one of DUO’s service desks or call +31 (0)50 - 599 77 55.

Applying for student finance

You can apply for student finance via www.duo.nl – Mijn DUO. Make sure to do so at least two months before the start of your programme. Before you can apply for student finance, you will need a DigiD. Request a DigiD with text message verification. After submitting your request, you will receive a letter with login details within five working days.

When applying for student finance, keep the following in mind:

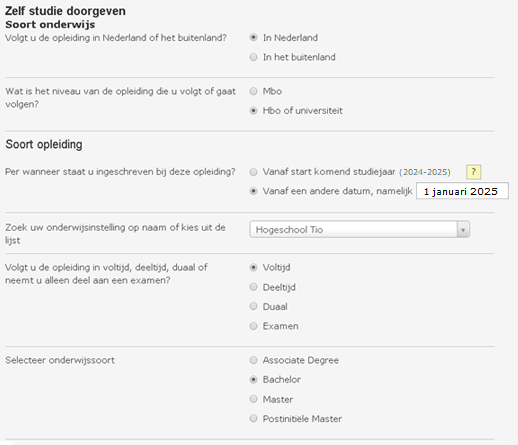

- For “education level,” choose “university of applied sciences or university.”

- Select the town of your Tio campus.

- For institute, choose “Tio University of Applied Sciences.”

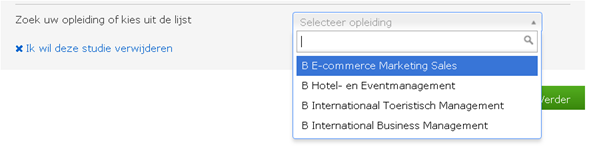

- For study programme, choose bachelor = ’B <name of your programme>’, associate degree = ’Ad <name of your programme>’ or post-initial master = ’M <name of your programme>'.

- For type of education, choose “fulltime.”

- For starting date, choose “other” and the date "1 January 2025".

The rest of the questions should be self-evident. You will see a confirmation of your application. Check the information you entered and if everything is correct, hit “agree” at the bottom of the page.

Applying for a tuition fee loan

In addition to the “standard” loan, you can also apply for a loan from DUO with which to pay your tuition fee. This loan is part of the student finance and is known as a tuition fee loan. Like the rest of the student finance, the tuition fee loan is paid out every month. After your study, you pay back the amount you loaned (with interest) under the same excellent conditions as the other loans DUO offers.

Applying for a tuition fee loan

Log in to Mijn DUO to apply for the (increased) tuition fee loan. There, you can apply for student finance for the first time or request to be eligible for a tuition fee loan. You can also indicate that you want to be eligible for a increased tuition fee loan (institutional tuition fee).

To be eligible for the increased tuition fee loan, you need a 'certificate of tuition fees'. You can request this certificate by e-mail at proofofregistration@tio.nl. You can upload the statement via 'mijn DUO' to qualify for the increased tuition fee loan.

If necessary, you can request an urgent payment to get the money sooner.Below, we will explain exactly how to apply for a tuition fee loan. This example concerns a student who applies for the full student grant and wants to be eligible for an increased tuition fee loan per 1 Januari.

Step 1

You click on the green button 'Aanvragen' (apply) in the tile 'Studiefinanciering (Student Finance).Step 2

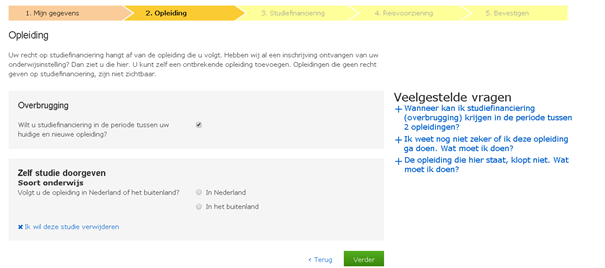

- At 1. Mijn Gegevens (My Details) you can check / complete your personal details.

- At 2. Opleiding (Education) you register your education (as shown below). If the education details are known by DUO, you will already see this data and click on Verder (Continue).

- Under Soort opleiding (Type of study programme) you can change the date as per when you are registered for this study programme. For students starting in mid-August, this is 1 August and for students starting in January it is 1 January.

Step 3

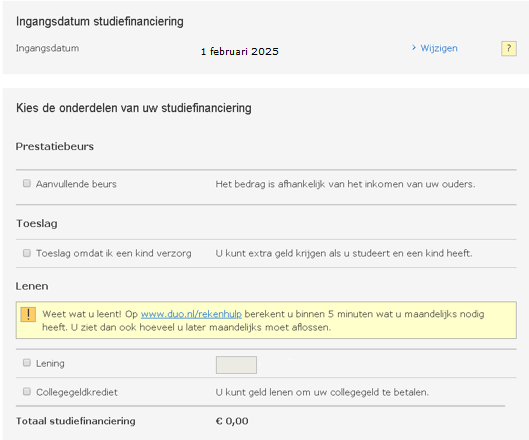

- The ingangsdatum (commencement date) is February 2025 by default in this example. Change this to January 2025.

- You then select the components of the student finance you want to apply for: aanvullende beurs (supplementary grant), lening (loan), collegegeldkrediet (tuition fee loan).

- Always apply for a supplementary grant! Even if you are not sure whether you qualify for it. DUO calculates whether you are entitled to it. If this is not the case, you can always borrow the amount.

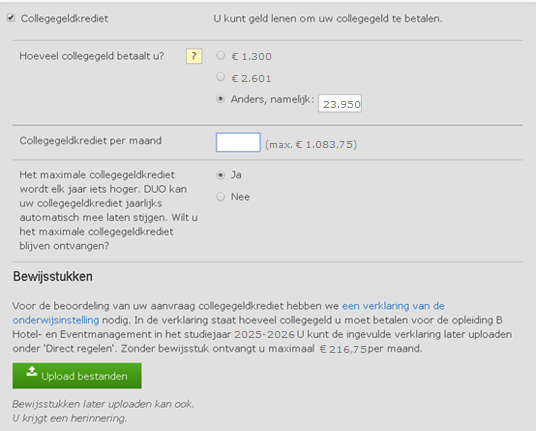

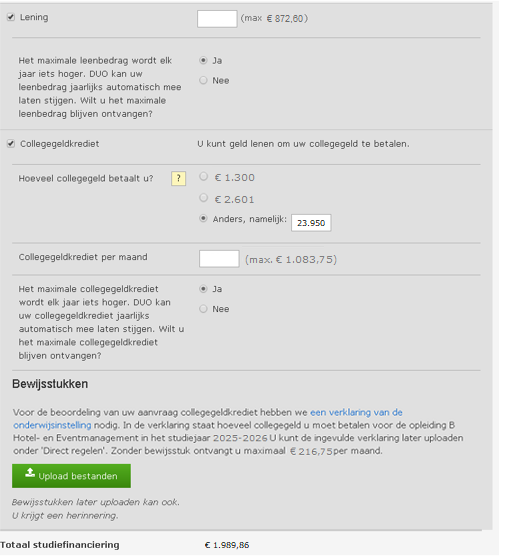

Step 4

- At 'Hoeveel collegegeld betaalt u?' (How much tuition fee do you pay?) you fill out the amount of the Tio tuition fee.

- At 'Collegegeldkrediet per maand' (Tuition fee loan per month) you fill out the desired amount. If you enter more than the maximum, the maximum will be requested. So always good to do that!

- You can also immediately upload your certificate of tuition fee that states that you are paying a higher tuition fee. DUO immediately creates a Task to assess this. You can also upload the certificate at a later time via Direct Regelen (Arrange immediately).

You can request the tuition fee certificate via Tio's student web (as described above).

Step 5

At the bottom of the page you will see the amount of student finance you will receive monthly (the amount in the example above is fictitious).Are you already receiving student finance?

If you are already receiving student finance, you can change your bachelor programme details (per 1 January 2025) by logging in to 'Mijn DUO'. You need to enter the information listed above regarding the Tio campus, the start date of your Tio bachelor programme, the end date of your current study programme and the name of the programme (fulltime) when filling out the change request form. If you have received student finance in the past, make sure to ask about the conditions of the performance loan that apply to you!

Supplementary grant

If your parents’ collective annual income is less than €80,000, you are eligible to receive a supplementary grant (partially) as a gift. The exact amount depends on your parents’ income. If this is less than € 30,000, you will receive the maximum amount. After earning your degree (within ten years), the supplementary grant will be turned into a gift. If you are not eligible to receive (the full amount of) this supplementary grant, you can loan the remainder.

Paying back the loan

You will start paying back the interest-bearing loan circa two years after completing your study. The maximum period during which you have to pay back the loan is 35 years, depending on your income (and that of your partner, if you have one). If you earn less than minimum wage, you will not have to pay back the loan. Furthermore, you will never have to pay back more than 4% of the extra income you earn above minimum wage. If you have any outstanding debt after 35 years, it will be waived.

Public transportation card

The public transportation card is part of your student finance. If you apply for student finance and a public transportation card, you can purchase an OV chip card via ov-chipkaart.nl. As a new student, you will automatically receive instructions regarding how to submit your OV chip card number to the OV chip card customer service department after registering with DUO. The student travel product will then be available for your OV chip card at any download unit. Once your student finance eligibility period begins, you can travel with the student travel product. If you already have a personal OV chip card, you can download your student travel product on it. Go to www.studentenreisproduct.nl/ for more information.

We recommend choosing a weekday subscription because of the many Tio activities that are hosted on weekdays. Additionally, several mandatory events are held off school grounds. With a weekday subscription, you will receive a discount when you travel during the weekend.

Changing your public transportation product during an internship abroad

If you are doing an internship abroad, you can receive compensation for your public transportation costs from DUO. Before you leave, you must cancel your student travel product at a download unit. Go to duo.nl for more information.

Student finance: loan or gift

Your student finance is a loan, which you have to pay back after your study. The applicable conditions are excellent. Only the public transportation card and the supplementary grant (depending on your parents’ income) may be turned into a gift. In that case, you must earn your degree within ten years after your first monthly student finance payment.

If you fail to earn a bachelor degree within ten years, the amount you loaned from DUO (including the public transportation card) will be turned into a loan.